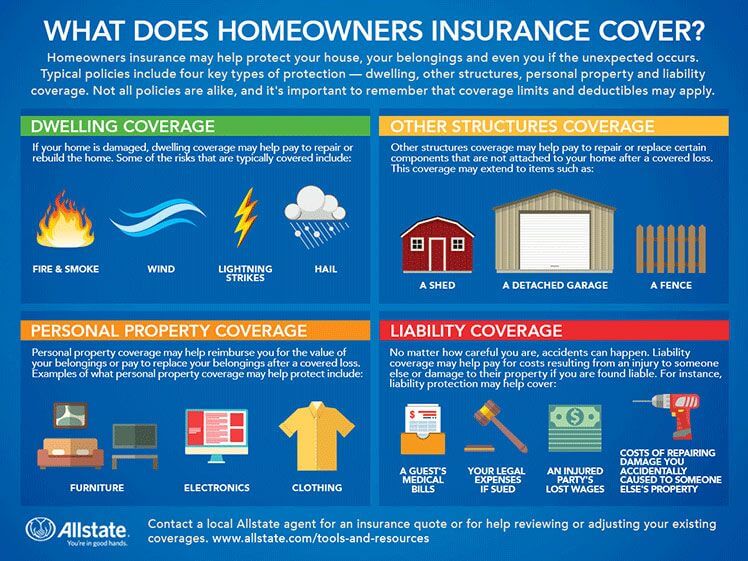

Homeowners insurance is a bundle of coverages (into a single policy) that can protect homeowners from unforeseen damage or loss from events such as weather, theft or vandalism. It provides relief in the form of cash or replacement of the contents of the home and the structure itself. It provides liability coverage against claims from others that may have been harmed on your property. It also provides coverage for the use of the home, as well.

Is Homeowners insurance required by law?

What does Homeowners Insurance cost?

The costs of homeowners insurance depend on a number of factors, including the coverages you select, features of your home and the value of your personal belongings. There may also be extra costs for additional coverage or increased coverage limits.

Covered perils

Basic-form covered perils:

- Fire

- Lightning

- Windstorm or hail

- Explosion

- Smoke

- Vandalism

- Aircraft or vehicle collision

- Riot or civil commotion

Broad-form covered perils:

- All basic-form perils

- Burglary, break-in damage

- Falling objects (e.g. tree limbs)

- Weight of ice and snow

- Freezing of plumbing

- Accidental water damage

- Artificially generated electricity

Special-form excluded perils:

- Ordinance of law

- Earthquake

- Flood

- Power failure

- Neglect

- War

- Nuclear hazard

- Intentional acts

What is property insurance?

You may also like

Car valuation in 2023: Tools and rules to get the most out of the sale

In 2023, the valuation of a car relies on modern tools and specific rules to get the most out of the sale. Today, values are established using online valuation systems, such as specialised websites and apps, which take into account various factors such as the model, year of production, mileage and general condition of the… Continue reading Car valuation in 2023: Tools and rules to get the most out of the sale

The latest news on pet insurance

In 2023/2024, pet insurance offers significant benefits for the care and protection of dogs and cats. These policies provide coverage for veterinary expenses, medical emergencies and other health needs of our four-legged friends. Coverage under pet insurance policies includes routine veterinary visits, treatments for illnesses and injuries, surgeries and therapies. Some policies may also cover… Continue reading The latest news on pet insurance

Online bank accounts in the US: latest news

In 2023/2024, online bank accounts in the United States offer a host of benefits and new features. These accounts allow you to manage your finances conveniently, quickly and efficiently, without having to visit a physical branch. Online bank accounts offer digital banking solutions, allowing users to bank from anywhere, at any time. One can make… Continue reading Online bank accounts in the US: latest news

Home Insurance in the US, the latest guide 2023

In 2023/2024, home insurance in the United States offers significant benefits to protect flats and villas. These policies provide cover against physical damage, theft, liability and other unforeseen situations that may occur in one’s home. Coverages provided by home insurance policies include damage caused by fire, flooding, storms, theft and vandalism. Some policies may also… Continue reading Home Insurance in the US, the latest guide 2023